Australia’s small businesses have persevered through the uncertainty of 2020-22, and now they face their ultimate challenge: to use all they have learned to fortify their business for recovery and growth. And they might have some new tools at their disposal, thanks to the government’s latest budget announcements.

According to BizCover’s 2022 Small Business Bravery Report, small business owners are divided on Australia’s economic recovery – 38% feel optimistic, and 35% neutral. However, they do have confidence in their own business growth, with 24% optimistic their business will grow and 38% cautiously optimistic in their business recovery.

The Federal Government is probably hoping its budget measures for small business might aid in that optimism, with more than $1billion committed in generous tax breaks for “the cost of business expenses and depreciating assets that support digital uptake, up to $100,000 of expenditure per year.”

Small businesses will be able to deduct 120% of digital upgrades, including laptops, portable payment devices, website improvements, and cloud-based software services. Plus, the $550million Skills and Training Boost will also provide a bonus 20% deduction on staff training expenses.

These incentives are designed to boost small business productivity gains, and in turn revenue growth – and potentially help recruit or retain staff. But will they address the fundamental issues keeping small business owners awake at night?

New dragons to be slayed

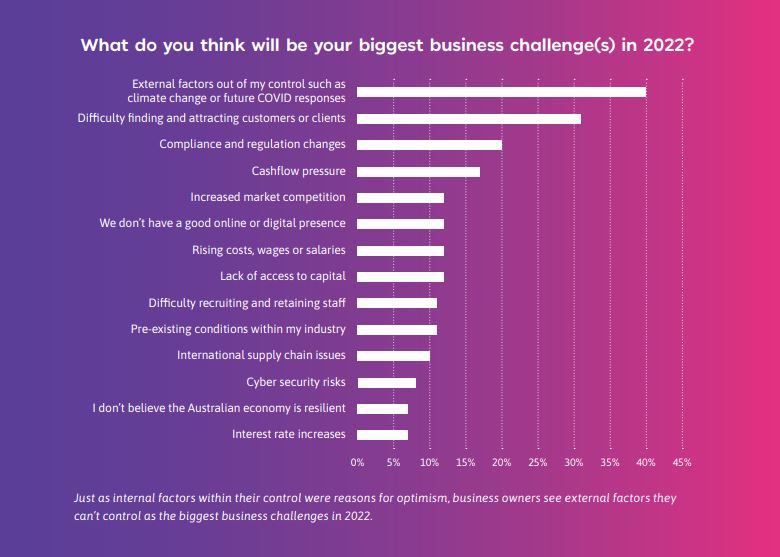

BizCover’s 2019 survey of small businesses found the number one constraint on growth was lack of customer demand, followed by competitor price pressures and rising overheads. Fast forward two tumultuous years, and it’s hardly surprising that the most pressing challenge in 2022 is ‘external factors out of my control’ – such as future COVID responses or climate change.

As supply chain shocks continue and petrol prices soar through the crisis in Ukraine, the impact of these external pressures keeps evolving. But could the budget help small business owners build resilience to elements they cannot control?

Business tax breaks can’t address these complex global challenges. However, they could potentially relieve some cash flow pressure – a major challenge for 2022 for 17% of small business owners. For the 12% who said, ‘we don’t have a good online or digital presence’, this could finally be the time to invest in marketing platforms and services – with the bonus write off applying to the costs of a new or improved website. And this in turn could also help address the major concern of the 31% of business owners who say it’s hard to find or attract customers or clients.

The ability to subsidise cloud-based software and platforms could also help some businesses better manage compliance and regulation changes – for example, by shifting to online accounting and workflow management systems, they may gain better visibility of their data and simpler reporting.

And in the face of a well-documented talent shortage, 12% say they have difficulty recruiting and retaining staff, and 12% are concerned about rising wages. Here, the ability to deduct 120% of the cost of training could help upskill current staff, or onboard less experienced talent.

Investing in adaptability

The response to the global pandemic certainly accelerated adoption of new technology – out of sheer necessity. And BizCover’s survey found small businesses who quickly moved to online solutions were more likely to report their 2021 business performance as good or very good.

But Australia’s small businesses have been lagging their Asia-Pacific counterparts when it comes to digital adoption, according to recent research from CPA Australia. Despite studies, including a 2021 Xero report, consistently finding IT investment pays off in increased revenue and profitability – and more time for higher value work.

“Small businesses have had to become more resilient, agile and innovative to survive the last couple of years, and they will be more prepared to take on new challenges,” says BizCover CEO Michael Gottlieb. “I think we will continue to see more innovation from these businesses as they strive to take on changing market conditions. I also think we will see record growth for new small businesses in Australia.”

As one Queensland-based health services provider told BizCover, “I feel fearlessly brave stepping into a new year with my business, knowing I’m going to grow my clientele and extend on my digital presence. Getting through 2021 was extremely hard with a lack of customers, but this year I know I am going to work harder than before to make sure I can succeed in 2022.”

In January, just 17% of small businesses told BizCover they plan to invest more in online platforms or technology. Perhaps the new budget tax breaks will be a deciding factor, and we’ll see that proportion grow further.

And for those small businesses who supply digital services or external training, there’s even more potential upside – with a further boost in their ability to attract new clients.

To learn more about how Australian business owners plan to recover and grow in 2022, download the 2022 Small Business Bravery Report.