Compare quotes from our trusted insurance partners:

On this page:

What is writer insurance?

As a self-employed, freelance writer, you know how to turn a phrase. But do you also know how to protect your business?

Failing to meet a deadline, a broken laptop, or falling for a cyber scam are all unplanned events that could spell trouble for your freelance writing or editing business. These issues could become costly problems for you and your business, which is why many freelance writers choose to take out business insurance

Why do writers need insurance?

Writers may need business insurance to do things like:

Pay legal costs if you face a liability claim

Protect your intellectual property.

Work as a contractor or sub-contractor

Safeguard against cybersecurity threats

More writing and editing professions we cover

BizCover has insurance options for a wide variety of occupations relating to writing and editing.

Publishers

Reporters

Document Editors

Songwriters

Playwrights

Proofreaders

Types of cover we offer freelance writers

BizCover has insurance options for many different professions in the arts, media and entertainment industry. Tailor your quote to your business, compare cover, and buy online in minutes.

Popular cover types for writers:

Authors & Writers could also consider:

Let’s cover your small business on the go

Start a quote to see how much you can save and buy online in minutes.

How much does freelance writers’ insurance cost?

Your business is unique. That means you might face different risks than others in your industry and may pay a different price for your cover.

With BizCover, insurance can be tailored to fit the size, risks, and needs of your business. The average cost of business insurance for a freelance writer with BizCover is $52.

How is the cost of insurance calculated?

Risks of the industry

Cover level amount

Annual turnover

Number of employees

Claims history

Customer Average Monthly Payment Report is based on 1 July 2023 to 30 June 2024 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply.

Get cover that works with the risks of your business

Select different cover amounts for each policy listed below.

This is the most you will be paid out if you need to make a claim.

Unsure how much to choose? Think about:

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to over yourself, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

Factors influencing cost

Risk of the industry

Cover level amount

Annual turnover

Number of employees

Claims history

Customer Average Monthly Payment Report is based on 1 July 2023 to 30 June 2024 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply.

Get cover that works with the risks of your business

Select different cover amounts for each policy listed below.

This is the most you will be paid out if you need to make a claim.

Unsure how much to choose? Think about:

Statutory professional requirements

Cover required by contracts

Number of employees being covered

Your contract value

Worst case scenario claim size

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to over yourself, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

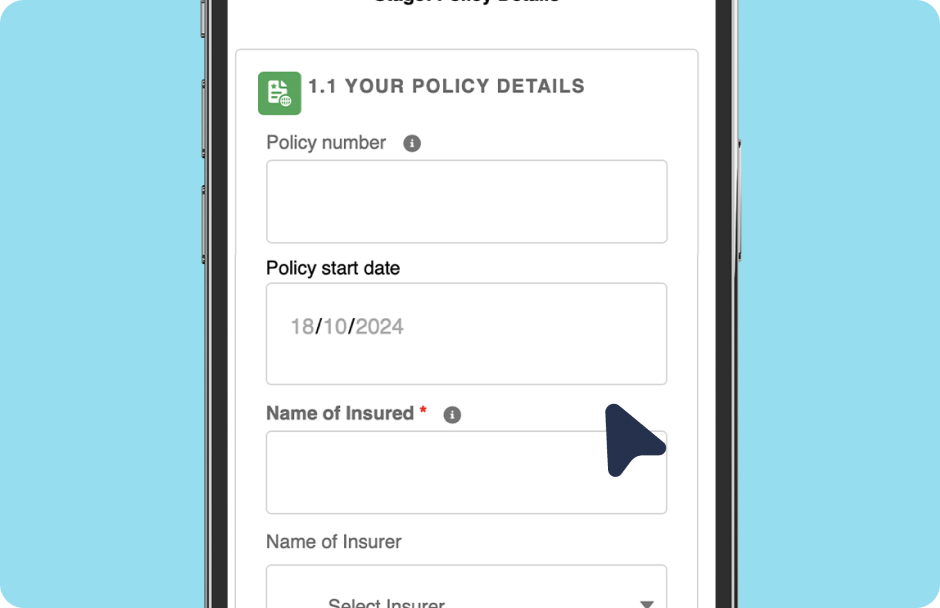

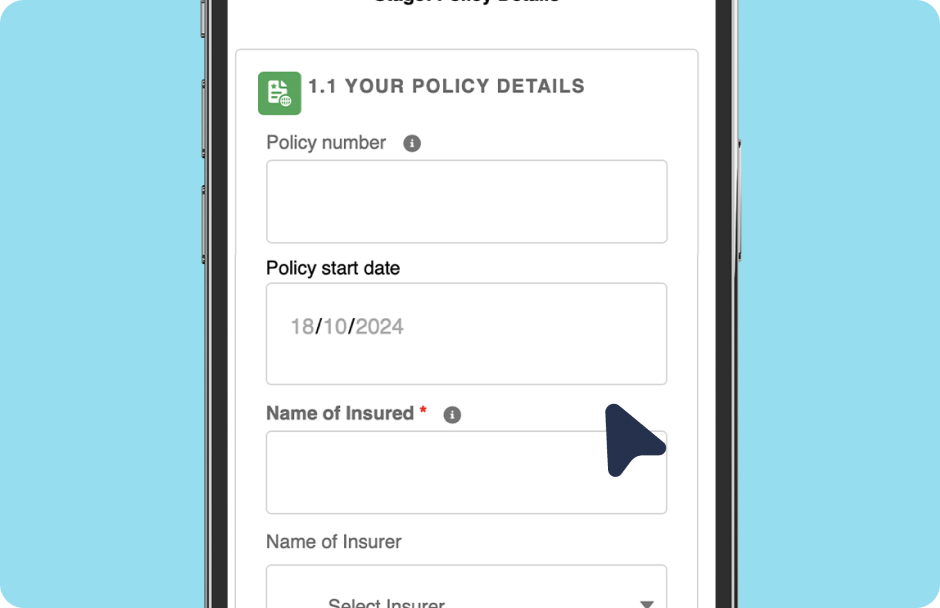

How It Works – Buying Online

5 easy steps to get instant cover online today

Select Profession

Pick Your Covers

Add Business Details

Compare Quotes

Get Covered Online

How To Make a Claim Online

We’ll assist you through the claims process & manage the claim directly with the insurer.

Let us know Fill out our

claims form and provide info

to support the claim

Receive extra support We

will assist you with your claim

Claim results We will notify

you of the claim outcome.

Award-Winning Tech & People

We’re not ones to blow our own trumpet, but we are pretty proud of our innovative insurance platform, outstanding team, and stellar workplace.

See How Much Others Have Saved By Purchasing a Policy Through BizCover

^ Savings made from January 2024 to April 2025. This information is provided as a guide only and may not reflect pricing for your particular business, as individual underwriting criteria will apply.

Frequently Asked Questions

Professional Indemnity (PI) insurance is an important form of protection for businesses that provide specialist services or professional advice. It is designed to respond to claims against your business for losses as a result of actual or alleged negligent acts or omissions in the provision of your professional service or advice. You may wish to consider Professional Indemnity insurance to protect yourself against claims relating to things like mistakes in your work or missed deadlines.

Writing is often a solo endeavour, but that doesn’t mean you never interact with others in the course of business. If you meet with clients in person—in your office, their offices, or even a local café—you may need Public Liability insurance to help manage third-party property damage or injury claims.

Looking for a way to protect your laptop, printer, and other electronics? You might want a Business Insurance Pack*. These customisable insurance packages (also known as a BizPack) offer a range of cover options for self-employed writers.

Electronic Equipment cover can help you repair or replace a broken laptop, and Theft cover could help you replace it if it’s stolen from your secured premises. You may also want to add other types of cover to your Business Insurance Pack, like Contents, Business Interruption, or Tax Audit insurance.

Do you have a website or professional social media accounts? Maybe you accept payments online or use third-party apps to run your business? You might want to consider Cyber Liability insurance to help you manage expenses and get your system back up and running after a cyber incident. This type of insurance is designed to help cover losses from claims arising from data breaches, business interruption and remediation costs following an actual or threatened data breach.

When you’re self-employed, your business’ success relies on you being there to get the job done. What would happen to your business if an accident or serious illness put you out of action for weeks, months, or even permanently? Personal Accident & Illness insurance could help you keep paying the bills if you cannot work following an injury or serious illness.

Real-life customer reviews verified by Feefo