Compare quotes from our trusted insurance partners

Why do Consultants need insurance?

You offer game-changing results for your clients; we offer a game-changing way to get your insurance. With just a few clicks or a phone call, you’ll get multiple competitive quotes from some of Australia’s leading insurers. Select your preferred policy and you’ll be covered instantly, so you can continue running your business.

Did you know?

If you’re a consultant working as a sole-trader you are personally responsible, both legally and financially, for all aspects of your business. In other words, there is a potential for you to have enormous liability exposure, which may affect your personal assets if things go wrong.

Why BizCover for your business insurance?

Built for small business

We know insurance and what makes

small businesses tick.

Clear and competitive pricing

You can compare and choose from a range of highly competitive prices right there on your screen. Seriously.

Cover to match your needs

You can tailor policies from selected Australian insurers to suit the needs of your business, and we are there to help!

Real people adding real value

Our friendly service team is on hand and

on a mission to make you smile!

What types of insurance do consultants often consider?

Professional Indemnity*

There are literally hundreds of different consulting professions, yet all are required to provide a professional service or specialist advice. Professional Indemnity insurance is designed to protect you from losses claimed by ... clients that are incurred as a result of your actual or alleged negligence or omission in the provision of your professional service or advice. Your Professional Indemnity policy, will cover the award of compensation payable to a third party together with your defence costs (which can include legal fees, investigator fees and expert fees) Read More

- Mistakes, errors or omissions in your work

- Professional wrongdoing

- Giving incorrect advice

Public Liability Insurance*

Public Liability insurance is a no brainer for all types of consultancy services. Public Liability insurance is designed to provide protection for you and your business in the event a customer, supplier or a member of the public are ... injured or sustain property damage as a result of your negligent business activities. Meeting with your clients, either at your office or if you visit them at their premises, means you’ll be exposed to potential mishaps and accidents – think of a client tripping over at your premises or if in the excitement of presenting your proposal at their office you knock over that expensive art work. Read More

- Third-party personal injuries

- Damage to customer property

- Your legal & defence costs for covered claims

Business Insurance*

Your clients bring in your income, but where would you be without your business assets? Business Insurance is an insurance package designed to provide cover for your business contents, stock, tools and commercial premises ... when an insured event occurs (such as fire, storm, theft or even accidental damage). A Business Insurance package can also cover your portable equipment, glass and for loss of revenue due to business interruption in specified circumstances. In addition, cover is available for public liability, tax audit, employment practices and statutory liability risks. Read More

- Third-party property damage & injury claimst

- Business property damage

- Unplanned business interruptions

Cyber Liability*

Consider the client data you may storing and the consequences if your systems were compromised. A cyber liability insurance policy is designed to help protect you from claims and support your profitability in the event of a cyber ... breach or attack. Costs associated with defending a cyber claim are also covered.Examples of the types of risks Cyber Liability insurance can assist with are inadvertent loss or release of customer personal information, cyber crime, cyber extortion/ransomware and business interruption due to a cyber event. Read More

- Costs following a cyberattack or data breach

- Breach notification expenses

- Business interruption costs after an event

Examples of some of the many consultancies who can take out Professional Indemnity Insurance through BizCover include:

-

Agricultural Consultants

-

Agronomist

-

Anthropologist

-

Cartographer

-

Geophysicist

-

Cultural Consultant

-

Land Surveyor

-

Auctioneer (Non-real estate)

-

Land Economist

-

Life Coaches

-

Marriage Counsellor

-

Personnel Consultant

-

Corporate & Business Consulting

-

Film Production Advisory Consultants

-

Fundraising Services (for not for profit entities only)

-

Photography (consultants and photographer)

-

Procurement Consultants and Probity Advisers

-

Residential Property Presentation Consultant

-

Shipping & Forwarding Agents

-

Community Development Consulting

-

Resettlement Consultant

-

Public Relations

-

Safety Consultants

-

Asset & Facility Management Consultant (Non-financial assets)

Common causes of claims

- Providing inadequate or incorrect advice

- Lack of appropriate due diligence & allegations of negligence

- Misstatement or misinterpretation

- Dissatisfaction with timeliness of completing work

- Confidentiality breaches

- Fraud and dishonesty

- Conflicts of interest

Hear what Our Consultants have to say

How it works?

4 easy steps to get covered and protect your business.

How it works?

4 easy steps to get covered and protect your business.

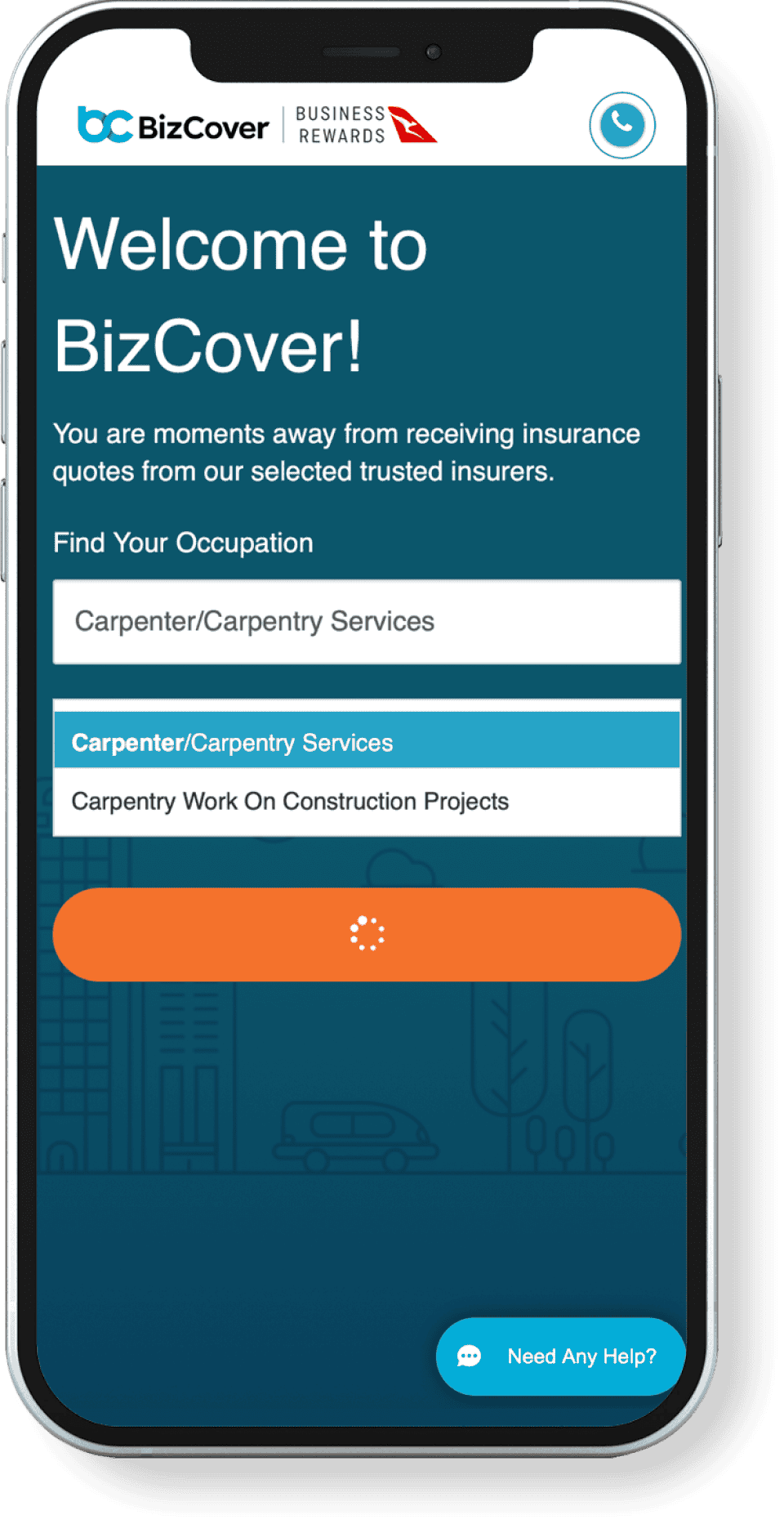

Select your occupation

Select your occupation to start comparing quotes.

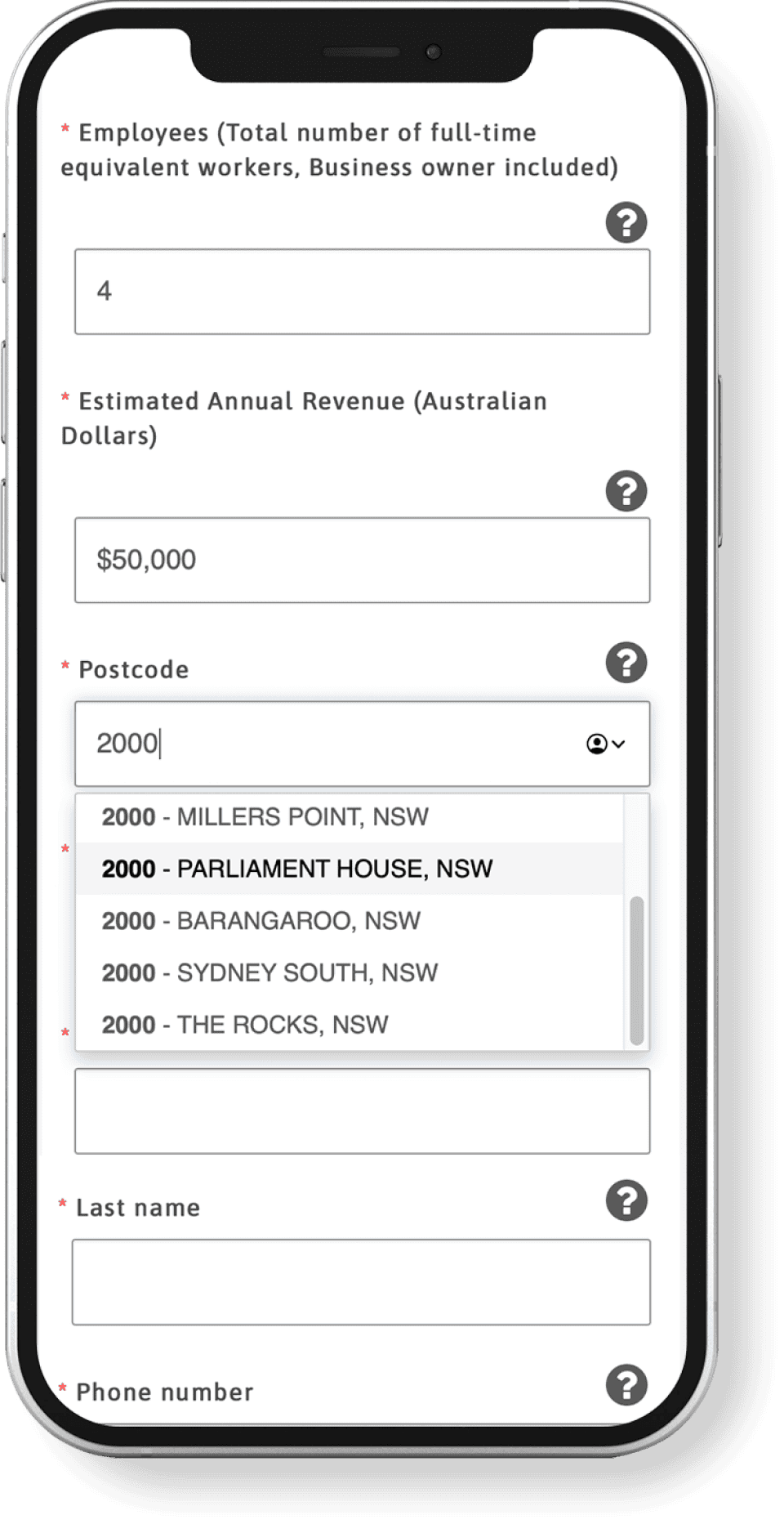

Enter your business details

Because your business is unique, we'll ask a few questions to help you compare quotes.

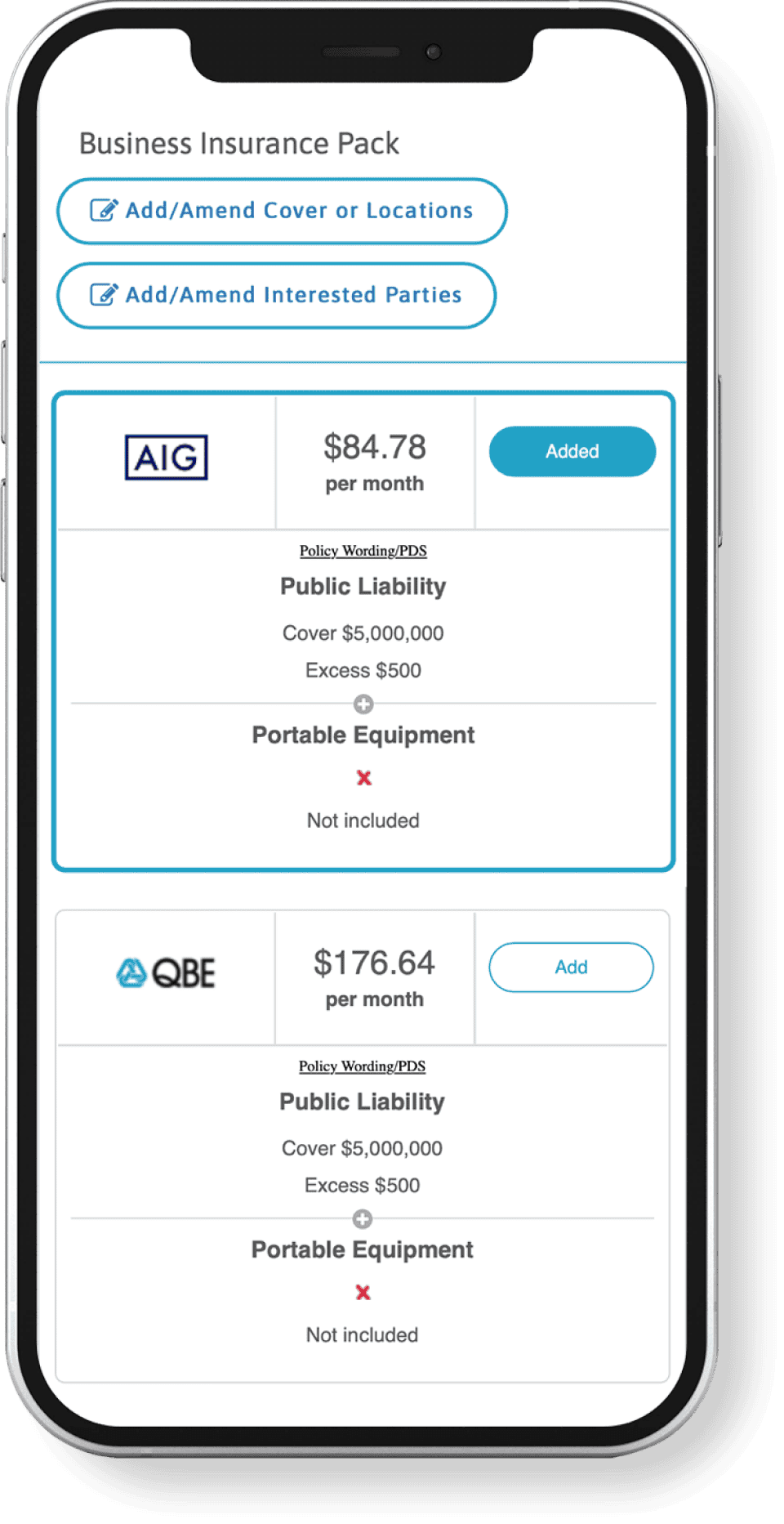

Compare quotes

Find out how much you can save and select the cover that best fits your business.

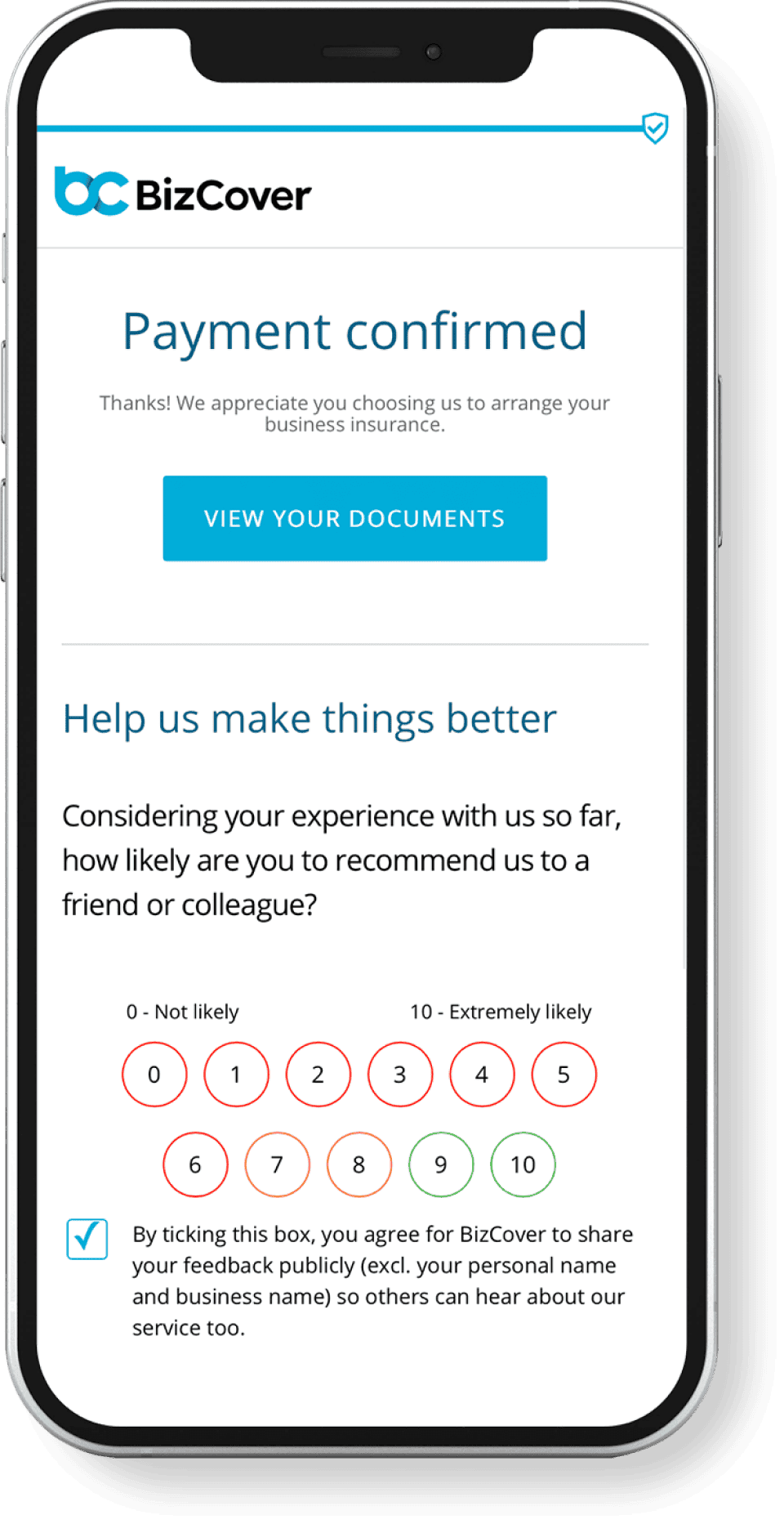

Covered in minutes

That's all!

Your policy documents have been delivered to your inbox.

BizCover customer savings

Here is how much other nurses and Allied Health professionals have saved with BizCover

Vanessa / VIC

Occupational Health And Safety (OH&S) Consultant

on Public Liability,

Professional Indemnity

Benjamin / NSW

Communications Consultant

on Management Liability, Professional Indemnity

Jake / VIC

Management Consultant

on Public Liability,

Professional Indemnity

Jo / NSW

Management Consultant

on Professional Indemnity

Kayelene / WA

Education Consultant

on Public Liability,

Professional Indemnity

^ Savings made from February/2024 to September/2024 This information is provided as a guide only

and may not reflect pricing for your particular business, as individual underwriting criteria will apply.

What our customers say about us

Customer Reviews

4.6/5

Independent Feedback based on verified reviews.

Simple & easy

The process was easy & simple to navigate, I found the cover I needed & received a quote, then purchased my insurance policy within minutes.

Great product - options, customer service and the product!

From the start - was easy to find, web site had all the information I required concise and in plain english. My options were available quickly and also the availability to customise those options - which I did. Payment options as well - again I choice an option. Also the expanse of insurers made me secure I had picked a site that knew the business and what customers needed - so thank you! Appreciated and it all came together within a day or two. NB Added bonus when I checked on a detail a Bizcover staff member answered the call quickly with all the info - they knew the product.

Convenient stress-free quote & insurance

Online setup is easy and convenient, especially with today's busy pace. One of the times I could not get an online quote for different insurance due to one of the questions I had answered, and they rang within the hour to assist ...

They're thorough, helpful and the staff are great!

Online setup is easy and convenient, especially with today's busy pace. One of the times I could not get an online quote for different insurance due to one of the questions I had answered, and they rang within the hour to assist ...

SIMPLE AND QUICK. RESPONSIVE CUSTOMER SERVICE. REASONABLE RATES

SIMPLE AND QUICK. RESPONSIVE CUSTOMER SERVICE. REASONABLE RATES

Affordable, convenient and stress free

So easy and convenient with very little wait time. Very impressed with the simplicity and price is very affordable.

Pleased with Bizcover online

Ease of use online but access to consultants if required. Quick quotes. Easy to pay online.

Instant quote and business up and running the next day!

I was able to purchase my insurance online and was available to start work that next day.

Very helpful. Very attentive. Good communication.

Very helpful. Very attentive. Good communication.

I appreciated the follow through phone calls ascertaining if assistance was needed. Thank you.

Friendly site, variety of insurance covers

Easy to use website, useful information and okanetynof choices and options

Good service, thank you.

very helpful with insurance advice. Easy to follow directions online for my insurance renewal.

Great platform

Fast and easy platform to find your PI & PL Insurance. Thanks and well done!

Excellent

Great friendly and efficient operator. Courteous and informative during the process topped off by a good price

Thanks for making this so, so simple.

I liked the simplicity of things, the modularity too. Some companies over do this, leading to an almost "fast food" feel to their products. This was not evident here, and the amount of choices reflected useful changes between options.

The prices are fair, half what I've paid when undertaking other business activity at a similar scale. It seems the customer wins here as well as the underwriter. I like that.

We will protect your

competitive quote for

30 days

Prefer to talk?

Call 1300 920 874 to speak with one of our business insurance

specialists. and speak to one of our insurance specialists

Compare quotes online or with one of our friendly agents.

If you're not ready to buy, we will protect your competitive quote for 30 days!

†Customer Average Monthly Payment Report is based on FY2023 and presented as a guide only. This is based on all aesthetics and wellness businesses that hold policies with us, and is not reflective of any one policy. It may not reflect pricing for your particular business, as individual underwriting criteria will apply.

*This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording.

© 2024 BizCover Pty Limited, all rights reserved. ABN 68 127 707 975; AFSL 501769