Compare quotes from our trusted insurance partners:

On this page:

What is carpenters’ insurance?

Insurance for carpenters helps protect residential and commercial carpenters, joiners, cabinet makers, and other carpentry professionals against the financial impact of injuries, property damage, lawsuits, and other common risks.

Business insurance helps carpenters protect their business, finances, and reputation. BizCover makes it easy to find affordable, personalised cover that matches your needs, whether you’re a self-employed contractor or running a small carpentry business.

Why do carpenters need insurance?

Carpenters may need business insurance to help them manage the cost of on-the-job risks, such as accidents, client claims, and unexpected bills. It may also be required to become licensed and fulfill contractual obligations.

Some clients may require proof of insurance before you begin work.

Get a building or construction license

Lease a workshop

Work as a contractor or sub-contractor

Pay legal costs if you face a liability claim

Who needs carpentry liability insurance?

Business insurance may be essential for many types of carpenters and carpentry businesses. We cover a range of carpentry occupations, including:

Independent Carpenters & Joiners

Custom Woodworking Businesses

Home Renovation Contractors

Deck Builders

Customised, on-the-go cover for your small business

Start a quote to see how much you can save and buy online in minutes.

Did you know?

Public Liability insurance is generally required for self-employed carpenters, subcontractors, and trades businesses to get a building or construction license, accept jobs, or enter worksites.

What types of cover do carpenters need?

Public Liability is one of the most common insurances that carpenters choose. With BizCover, you can build an insurance package that suits your carpentry or joinery business.

Common insurance cover for carpenters:

Carpenters may also consider:

How much does carpenters’ insurance cost?

Carpenter’ insurance costs an average of $79 a month with BizCover*.

However, your premiums will depend on different factors, such as the services you provide, the size of your business, and the cover amount chosen.

*Customer Average Monthly Payment Report is based on 1 July 2023 to 30 June 2024 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply.

Get cover that works with the risks of your business

Select different cover amounts for each type of insurance, including Public Liability cover up to $20 million and Professional Indemnity cover up to $10 million. Personal Accident & Illness benefits up to $4,000 a week are also available.

Unsure how much to choose? Think about:

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to over yourself, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

Customer Average Monthly Payment Report is based on 1 July 2023 to 30 June 2024 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply.

Get cover that works with the risks of your business

Select different cover amounts for each policy listed below.

This is the most you will be paid out if you need to make a claim.

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to over yourself, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

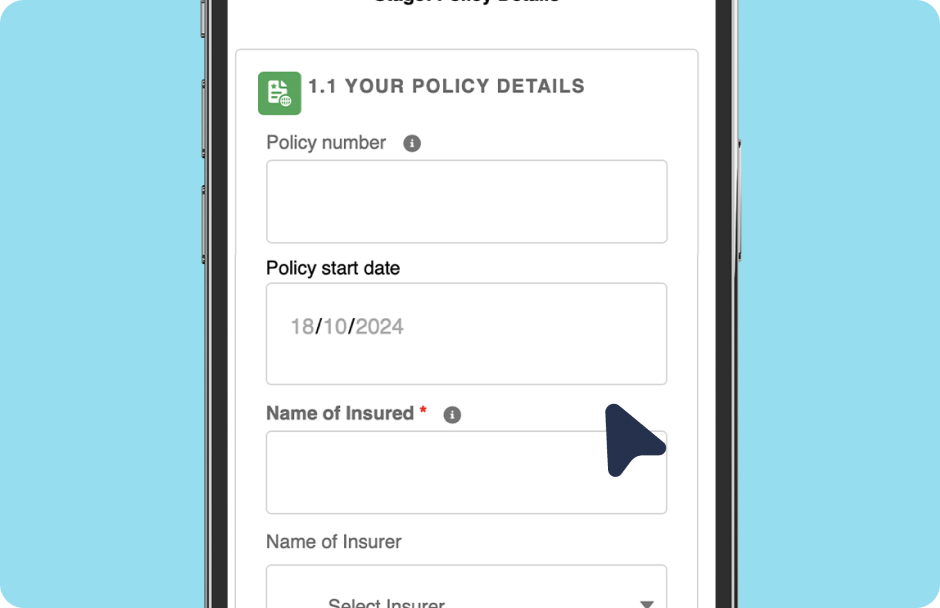

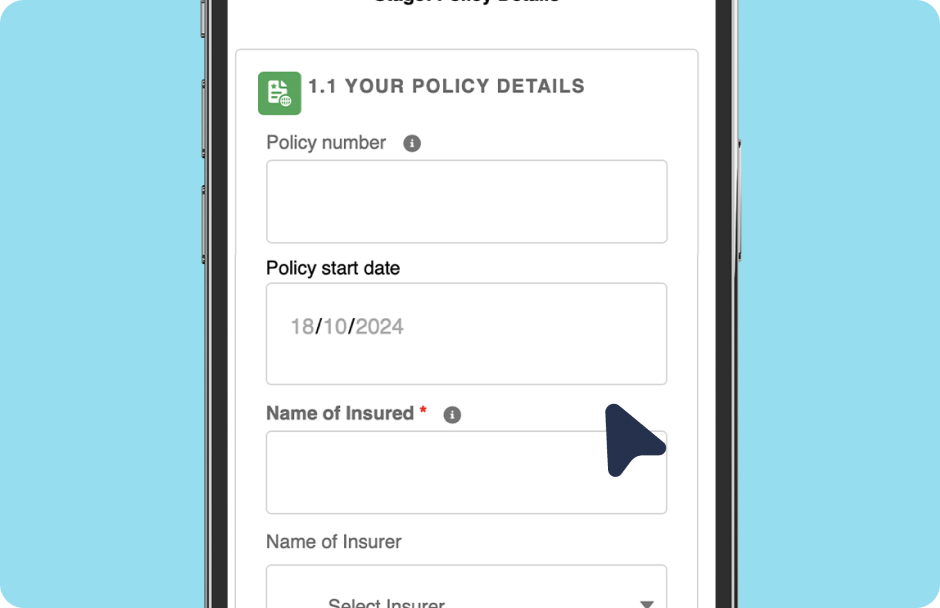

How It Works – Buying Online

5 easy steps to get instant cover online today

Select Profession

Pick Your Covers

Add Business Details

Compare Quotes

Get Covered Online

How To Make a Claim Online

We’ll assist you through the claims process & manage the claim directly with the insurer.

Let us know Fill out our

claims form and provide info

to support the claim

Receive extra support We

will assist you with your claim

Claim results We will notify

you of the claim outcome.

Award-Winning Tech & People

We’re not ones to blow our own trumpet, but we are pretty proud of our innovative insurance platform, outstanding team, and stellar workplace.

See How Much Others Have Saved By Purchasing a Policy Through BizCover

^ Savings made from January 2024 to April 2025. This information is provided as a guide only and may not reflect pricing for your particular business, as individual underwriting criteria will apply.

Frequently asked questions

Carpenters can choose from a variety of insurance options to protect different parts of their businesses. Depending on the policies you choose, you can protect your finances from unexpected costs related to third-party property damage, accidental injuries, theft, equipment damage, lawsuits, and more

Public Liability may be required for carpenters to get certain building or construction licenses in some parts of Australia. Before beginning any project, you may want to check the insurance requirements in the state or territory where you work.

Generally speaking, carpenters who provide professional advice to clients or other contractors may need Professional Indemnity insurance.

If you add Portable Equipment insurance to a Business Insurance Package, you can protect your tools and equipment. Portable Equipment cover may help you repair or replace essential tools and equipment needed to do your work and run your business.

Personal Accident & Illness insurance could be your Plan B to help protect your finances while you recover from workplace injuries. A Personal Accident & Illness policy can help carpenters replace lost income if they are unable to work due to injury or illness. You can also add optional cover for death and disablement to your policy.

Policy options are available to cover your employees. This must be selected/added before purchasing the policy to include coverage for employees

Self-employed carpenters can choose from a range of cover options, including Public Liability, Professional Indemnity, Portable Equipment, Personal Accident & Illness, and many more. BizCover makes it easy for self-employed carpenters to find cover that suits their individual needs

Business Insurance Packages are an easy and convenient way for carpenters to cover several parts of their business in one go. You can add up to 15 cover options to your Business Insurance Package, such as Public Liability, Portable Equipment, Building, and Contents.

Real-life customer reviews verified by Feefo