The fastest growing business sectors in Australia for 2025

Small businesses play a vital role in Australia’s economy, driving innovation, creating jobs, and demonstrating remarkable resilience and adaptability year after year.

By collating all new small business insurance policy leads from 2023 and 2024, we conducted a comprehensive analysis to identify the small business sectors that have been growing and those that have been slowing in 2024.

Sharon Kenny, Head of Marketing here at BizCover, says, “In a time when economic challenges and rising costs are making it harder than ever for small businesses to thrive, it’s inspiring to see that some industries are continuing to adapt and grow.”

So, which small business sectors are growing and which are slowing down? Discover how these insights can help you prepare for the evolving small business landscape in 2025.

For those looking to protect their small business in the new year, consider taking a look at our business insurance options.

Key takeaways

- Of over 70 small business sectors, the top three that saw the most growth in 2024 were Aged and Disability Care, followed by Cleaning and Gardening, and Post-Construction Services.

- The top three fastest-growing sectors in Australia with the biggest changes YoY were Societies, Associations and Groups, Tax Services, and Property.

- The business sector that saw the highest decline in 2024 was Data Processing, Web Hosting and Electronic Information Storage Services. This was followed by Surveying and Printing.

- Aged and Disability Care was the top sector in all states and territories, except ACT. Information Technology (IT) was the top sector there.

Top 10 Growing Small Business Sectors in Australia

By analysing the overall volume of small business insurance requests, we determined which small business sectors saw the most growth in 2024.

“This is a reliable indicator of industry growth,” says Kenny. “Simply put, more new business insurance requests correlates to more new small businesses.”

Aged and Disability Care

Of more than 70 business sectors analysed, the Aged and Disability sector has experienced the most growth in 2024 in Australia, with the largest overall volume of small business insurance requests. This substantial increase in insurance requests suggests a significant rise in the number of new businesses emerging within this sector.

Says Kenny, “This is not an entirely surprising outcome, given that the NDIS already supports over 640,000 participants and continues to grow rapidly.”

Cleaning and Gardening

Cleaning and Gardening was the next small business sector in Australia to see the most growth with the second largest overall volume of small business insurance requests in 2024.

This is, in part, tied to rising demand from time-poor households, as well as ageing populations and government subsidies for these essential services.

“With less older Australians looking to move into assisted living, there is increased demand for assistance with house-related tasks and further fuelling demand is the fact that government support programs like the NDIS and aged care services that subsidise these essential services,” says Kenny.

Post-Construction Services

Post-Construction Services refers to a range of tasks performed by specialists after the construction or renovation of a building, including carpenters, painters, plasterers and tilers. The purpose of Post-Construction Services is to prepare the property for use, whether that’s commercial or residential.

Interestingly, Post-Construction Services had the third largest volume of small business insurance requests in Australia, whereas Building and Construction only just slipped in at number 20. This suggests that more small businesses may be focusing on Post-Construction Services rather than Building and Construction, potentially reflecting a growing demand for these specialised services.

Though these three sectors were Australia’s top growing sectors nationwide in 2024, their year-on-year (YoY) growth varies significantly when broken down by state, which is discussed later on in the study.

Top 10 small business sectors in Australia with the fastest growth

We compared data from 2023 to 2024 to discover which small business sectors had seen had the most significant jump in new business insurance quotes from 2023 compared to 2024. This data informed us of which sectors have had the fastest year-on-year growth.

Societies, Associations and Groups

The number one position was held by Societies, Associations and Groups with 36.2% increase in small business insurance requests in 2024 compared to 2023. This broad sector includes charity organisations, not-for-profits and church operations.

“The significant increase in new business insurance quotes in this sector compared to the previous year could show that there is a renewed focus on social connectivity and community-minded projects that people want to get involved in,” says Kenny.

Additionally, it could also reflect the growing need for Australians to rely on charity organisations during the cost-of-living crisis.

Tax Services

Tax Services came in at number two with a YoY growth of 34.6%, highlighting a growing demand for professional, expert financial advice. This could be driven by individuals seeking assistance in making smart financial and investment decisions or small business owners needing help with their taxes, or a combination of both.

Property

The third fastest-growing sector from 2023 to 2024 was Property. This sector placed behind Tax Services by only a small margin, with a YoY growth of 34.3%. Rising population growth, urbanisation, and increased investment in both residential and commercial properties are likely contributors to the Property sectors rapid growth.

Complementary Therapies (32.7%) and General Services (31.8%) came in at number four and five respectively. Within the top five sectors, there was only a 4.4% difference between first and fifth place.

Says Kenny, “This shows a consistent surge across very diverse industries, demonstrating that various sectors can benefit from recent broad economic and social trends – such as consumer awareness, demand for personalised, niche services, and shifts in lifestyle priorities.”

10 small business sectors in Australia with declining growth

While some sectors saw booming growth in 2024, others saw a decline in small business insurance requests. This could reflect recent shifts in technology trends, consumer preferences, the cost-of-living crisis and industry demands.

Data Processing, Web Hosting and Electronic Information Storage Services

The small business sector that shrank the most in 2024 based on the least amount of new business insurance quotes was Data Processing, Web Hosting and Electronic Information Storage Services.

This sector may have been impacted due to recent advancements in automation and the dominance of large cloud service providers in the market. Many businesses these days may simply prefer to opt for a comprehensive service provider rather than dealing with multiple smaller, niche providers. These factors could make it difficult for new players to enter the market and establish themselves.

Surveying

Surveying came in at second place as the small business sector that had shrunk the most in 2024. The dip in this sector could reflect a slowdown of infrastructure projects, both public and private. On the other hand, like the number one spot, Surveying could possibly be suffering because clients prefer to use firms that bundle everything together – such as engineering, construction management and environmental assessments as well as surveying.

Printing

In third place was Printing. Digital transformation and technological advancements could contribute to shrinkage in this area, with many organisations now going paperless and a declining demand for print media.

What to know about industries with declining growth

The fact that these sectors are shrinking should not discourage business owners or entrepreneurs currently working in these areas or those thinking of starting a new business.

“Even a shrinking industry can present unique business opportunities for those willing to take on the challenge,” says Kenny.

Here are some ways you could capitalise on market shrinkage for your small business if you work within one of the affected areas:

- Data Processing, Web Hosting and Electronic Information Storage Services: Pivot to offering specialised services to a specific industry (such as healthcare, which is growing), so that your business becomes well-known within a niche area.

- Surveying: Expand your expertise to include sustainable planning or advanced geospatial technologies. As a multi-skilled surveyor, you could attract business from those looking for more of an “all-in-one” package.

- Printing: Many of your clients are probably looking to cut costs and lessen their environmental impact by going paperless. You can help support them by focusing on sustainable, eco-friendly printing practices that offer a unique, artisanal solution that still meets consumer needs.

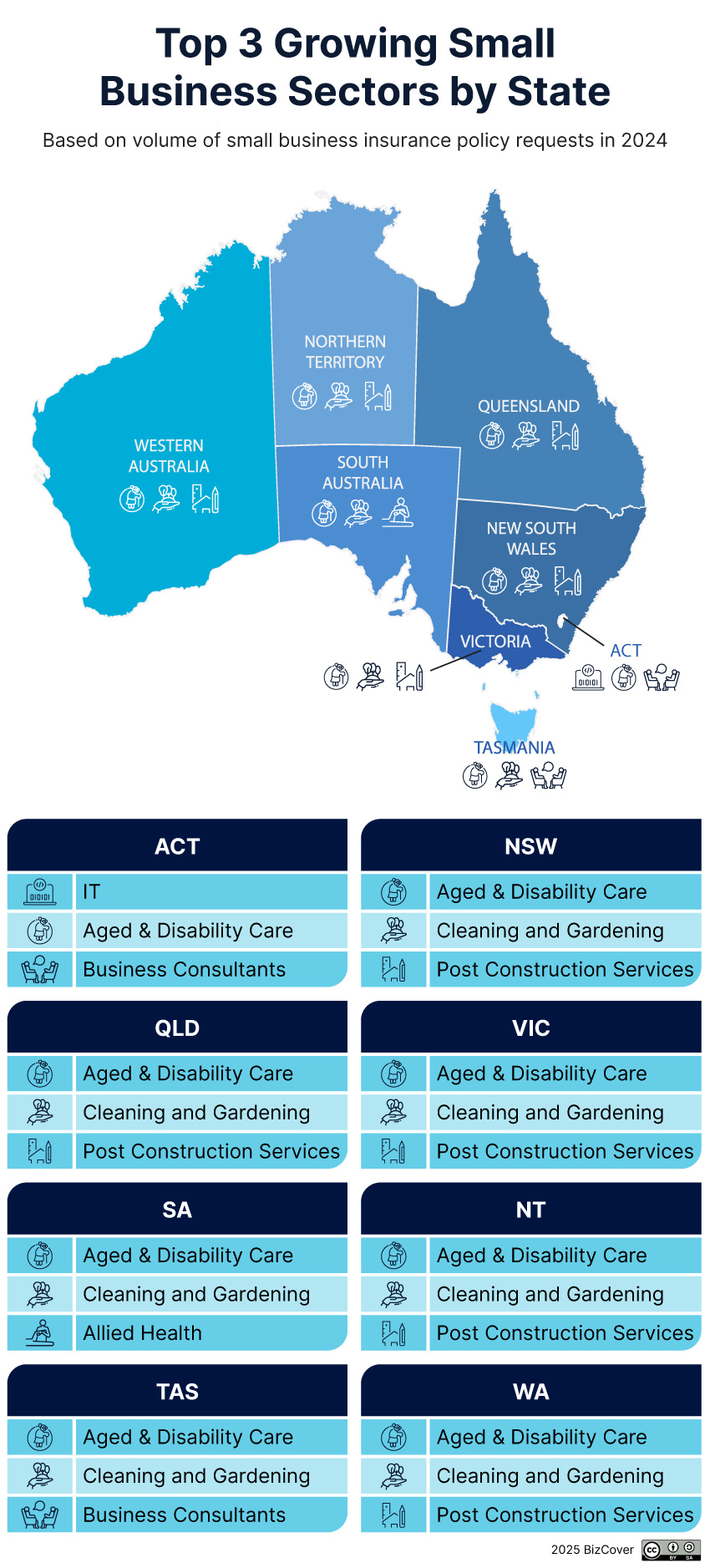

Top 3 Growing Small Business Sectors by State

While Aged & Disability Care, Cleaning & Gardening, and Post-Construction Services are the top growing small business sectors nationally for 2024, the top three sectors vary across states.

In New South Wales, the Northern Territory, Queensland, Victoria and Western Australia the top three growing small business sectors align with the national trend: Aged and Disability Care, Cleaning and Gardening, and Post-Construction Services.

However, South Australia and the ACT deviate from this pattern. South Australia’s top three included Aged and Disability Care, Cleaning and Gardening, and Allied Health; while the ACT’s top three showed a marked difference from the rest of the country with IT in the number one spot, followed by Aged and Disability Care and then Business Consultants.

Similar to the ACT, Tasmania had Aged and Disability Care and Cleaning and Gardening in spots one and two, followed by Business Consultants in third place.

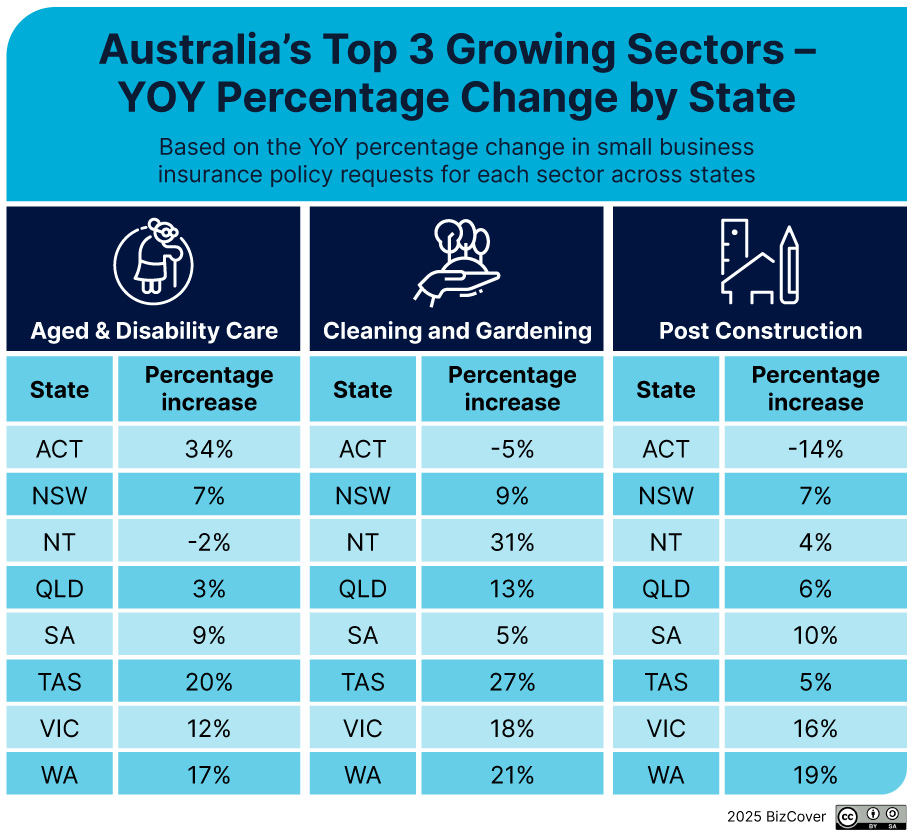

Australia’s Top 3 Growing Small Business Sectors – YoY Growth Breakdown by State

As previously stated, Aged & Disability Care, Cleaning & Gardening, and Post-Construction Services were the top growing sectors nationwide in 2024. However, the YoY growth for these sectors varies significantly when broken down by state.

“By analysing the year-on-year growth of each of these sectors at a state level, it’s possible [for business owners and entrepreneurs] to discern trends, capitalise on opportunities and prepare for upcoming challenges,” says Kenny.

Aged and Disability Care

The ACT had the biggest increase for Aged and Disability Care across all states, despite the fact this sector was only the second most popular in the ACT after IT. Comparing 2023 numbers to 2024 numbers, Aged and Disability Care had a huge growth of 34%. In comparison, the next closest was Tasmania at 20% and then Western Australia at 17%.

The state with the lowest YoY growth for Aged and Disability Care was the NT, with a negative figure of –2%.

Cleaning and Gardening

Cleaning and Gardening saw the biggest YoY growth in the NT, with an increase of 31%. This could reflect a growing need for professional domestic services in areas that are slowly becoming more urbanised. Tasmania (27%) and Western Australia (21%) came in second and third.

Flipping things around, the ACT had the lowest growth for this sector with a noticeable decline of –5%.

Post-Construction Services

Western Australia had the biggest YoY growth for Post-Construction Services, with an increase of 19%. Victoria had the second largest YoY growth at 16%, followed by South Australia at 10%.

The ACT saw a very dramatic decline in this sector with a –14% drop from the previous year.

Looking ahead to 2025

From the strong surge in Societies, Associations and Groups to the continued demand for Aged and Disability Care, these growing sectors can represent new opportunities for Aussie business owners.

By analysing these numbers to discover which small business sectors are growing and which ones are slowing down, it’s possible for small business owners and entrepreneurs to predict future trends, prepare for the future and help to protect business interests.

Says Kenny, “Rather than being intimidated by the growth or decline in their sectors, small business owners should utilise times of change by leveraging these shifts to build on their strengths.

Focusing on what makes your business stand out—whether that’s offering a specialised service or reaching a niche audience—can help position you for long-term success. Another way that many small business owners choose to protect their businesses is by purchasing business insurance. Visit BizCover today to get fast, easy insurance quotes online.

Methodology

BizCover analysed all new small business insurance policy leads in 2023 and 2024 to identify the fastest-growing small business sectors in Australia and per state.

The data for this analysis was collected internally, concentrating on the volume of small business insurance leads per sector and the YoY percentage change across more than 70 business sectors.

BizCover also examined the most requested small business sectors, focusing on the total volume of insurance policy requests rather than just the percentage increase.

The data covers the period from December 2023 to November 2024 and is accurate as of December 2024.

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording.

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording or Product Disclosure Statement (available on our website). Please consider whether the advice is suitable for you before proceeding with any purchase. Target Market Determination document is also available (as applicable). © 2025 BizCover Pty Limited, all rights reserved. ABN 68 127 707 975; AFSL 501769.