Technology has revolutionised the way we shop; from how we browse for a product/service all the way down to the payment process. ‘Buy Now, Pay Later’ is one of the newest developments in digital payments, and with the near-irresistible promise of interest-free credit, their growth is threatening credit card providers and the financial sector at large.

But with personal debt on the rise, will this growth continue, or will these services be forced to regulate their users? Here’s what we know.

How does Buy Now, Pay Later work?

Buy Now, Pay Later (BNPL) services allow consumers to receive a product now and pay for it in smaller instalments over a set period. This digital payment option is available both online and at select retailers, and unlike traditional forms of credit, there are no fees. This means the user never pays more than the original price of the product.

Depending on the provider, most allow you to add your account to Apple pay, making in-store purchases as easy as tapping a credit card. Online payments using BNPL are no longer difficult – they are made simply just by logging into your account after being redirected from your cart. But with so many options out there, the biggest challenge can be simply deciding which one to use.

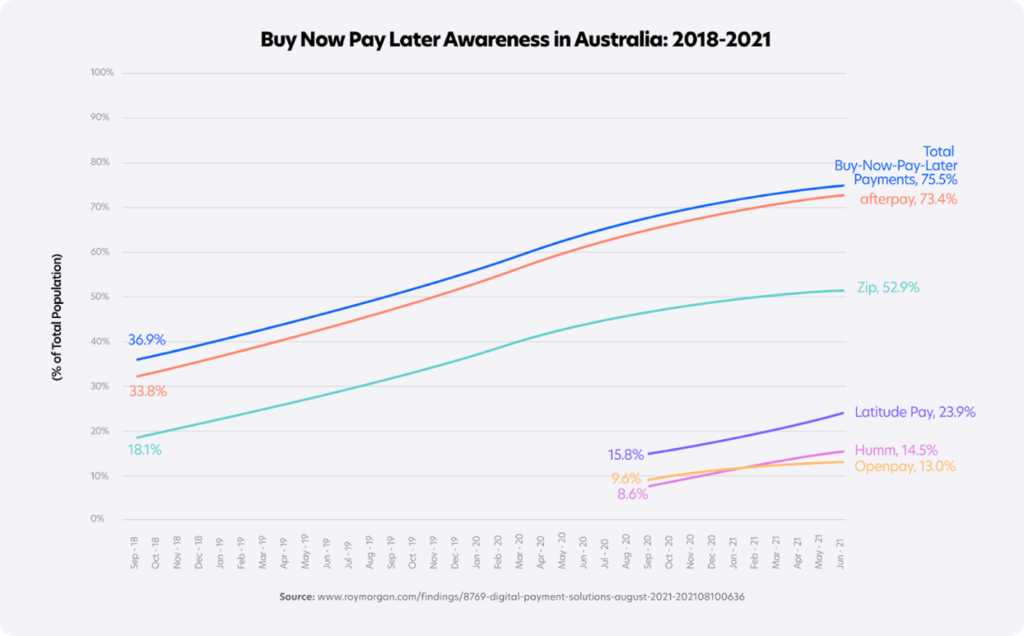

Creating a BNPL account is as easy and quick as creating a social media account, which means many users are signed up to more than one platform. Afterpay, Zip, Latitude Pay, Humm and Openpay are the top 5 players in the Australian market and they all differ on their spending limits and late fees. While these BNPL platforms openly speak about how their services focus on transparency and flexibility in spending, some argue that it has opened the door to a new age of consumer debt.

The rapid rise of BNPL services

BNPL services have seen immense global and national growth since their formation and are showing no signs of slowing down. The Australian market alone is expected to grow by an annual rate of 24% between 2021 and 2028, and we can expect mass widespread adoption of the service.

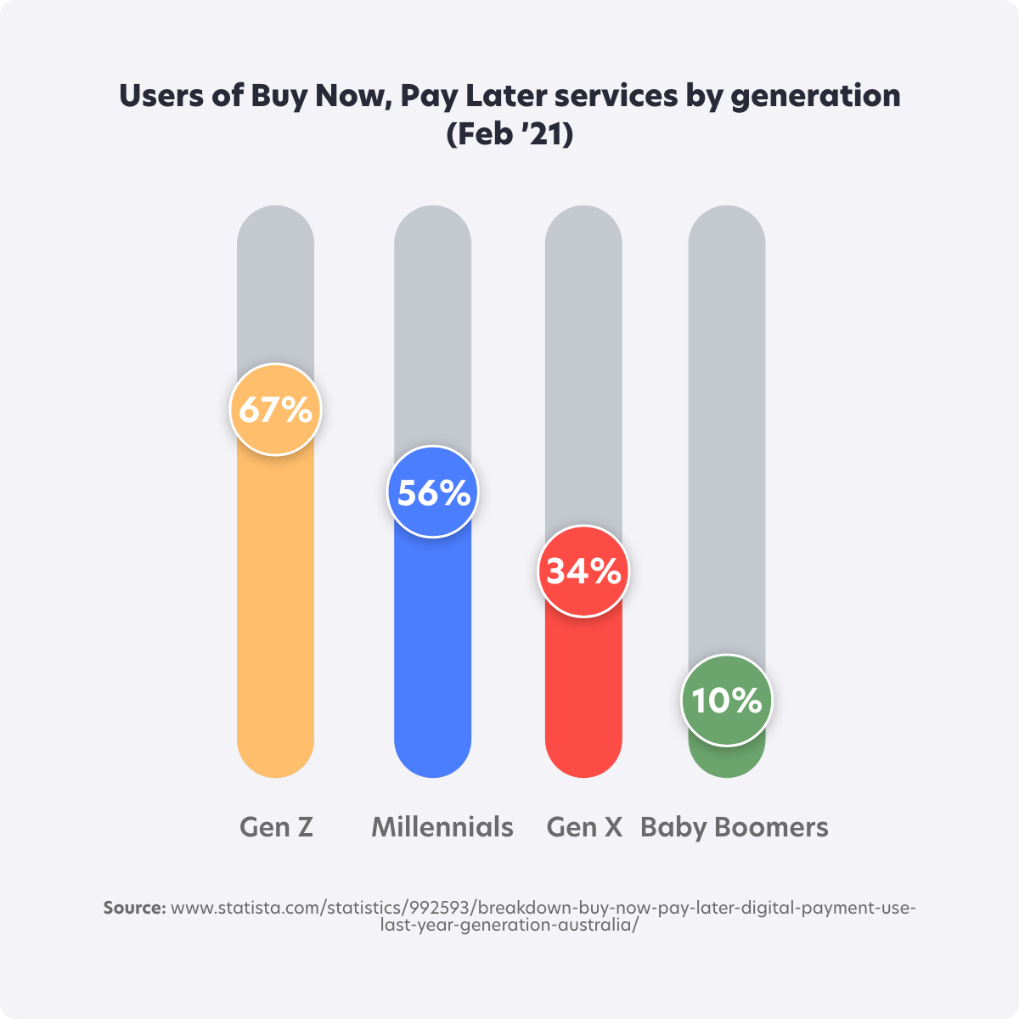

As of this year, over 75% of Australians aged 14 and up are aware of BNPL, a whopping increase from 36.9% in 2018. COVID-19 has been a major contributor to this growth as lockdown boredom and job cuts had a large influence on consumers’ purchasing habits. Gen Z, the predominant users of BNPL, are 2.5 times more likely to work in an industry that has been affected by social distancing restrictions and closures. Therefore, temporary losses of income meant these consumers were forced to find new ways to manage their expenses.

However, these habits have remained two years on. It was revealed that consumers are spending 18% more this year than the previous year, and they are doing it more often, with 40% of shoppers making an online purchase AT LEAST once a week. There has also been a particular increase in the number of retail stores offering BNPL options and it has become just as easy as traditional payment methods.

How does BNPL differ from credit cards?

BNPL has slowly started to overtake credit cards as a consumer’s preferred payment method, with credit card usage declining by 6.6% between 2019-20. But what exactly makes these services so appealing?

The answer is simply ease of use and access. In a technologically led world it is no surprise that consumers want to streamline the purchasing process, and BNPL does just that. However, what some users don’t know is that late payments using BNPL services can affect your credit score just as they do on a credit card.

Source: Canstar 2021

Who is using BNPL?

The demographic of BNPL users has certainly shifted through the years since its formation. Ecommerce is changing and we’re now seeing the younger generations, especially Gen Z, account for most of the global online shopping activity. These consumers are digitally savvy by nature and with ecommerce now fully integrated directly into social media platforms, it has become much easier to make a purchase, often with only a few clicks between the purchaser and the product.

BNPL has opened the financial doorway for these consumers to purchase luxury items that they otherwise would not be able to afford. While Gen Z and millennials are earning more in recent years, their wealth status remains low due to the affordability crisis of Australian living. However, this doesn’t stop them from spending. These segments are spending more than their predecessors, and have a purchasing power of $140b.

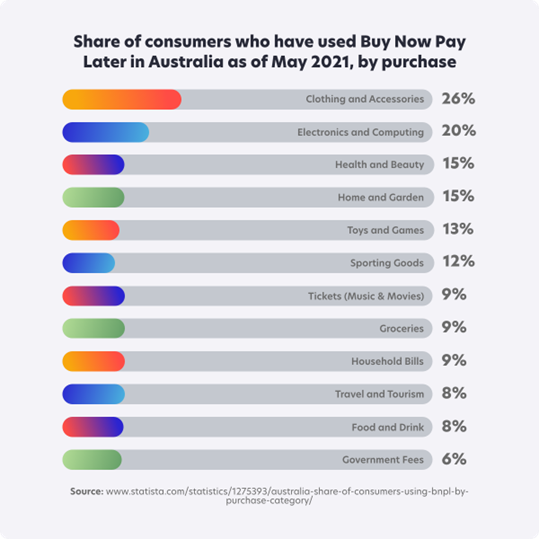

Whilst BNPL services are most commonly used in providing assistance for larger fashion or technology purchases, more and more people are finding themselves using BNPL to cover basic weekly expenses such as groceries.

BNPL’s impact on the financial sector

While BNPL services still don’t quite compare to the huge lending of banks, their growth is threatening and has left banks scrambling to come up with their own solutions. The impact on credit card usage is clear; it is on the decline, as younger consumers are attracted to the freedom provided by these digital payment services.

To try and combat this, banks such as Westpac have tried to increase the attractiveness of credit cards by waving interest and late payment fees. However, BNPL still reaps the benefits of convenience, which is a key purchasing factor amongst digital natives.

“Sites with BNPL options benefit from conversion rates that are up to 2% higher than sites that do not”

The huge uptake of these services is not entirely positive, as young consumers are slowly driving themselves into huge amounts of debt. It is reported that BNPL users have a 6.4% chance of entering financial hardship, which is 1.5% higher than non-users of the same age bracket.

With one in five users missing their repayments, these consumers are now turning to credit cards to manage their BNPL debt and extend their lending period. So why are these services not currently regulated in Australia? For a loan to be regulated under the National Credit Code, it requires a fee to be charged to consumers, and since BNPL services only charge merchant fees, they fall outside of this regulation.

However, this regulation may be changing. Financial Counselling Australia have recently called on ASIC to review their current mandate and include BNPL as a form of credit following their findings on the ramifications of BNPL debt.

“84% of counsellors reported that half or most of their clients reported BNPL debts, an increase of 53 points in 12 months”

Some banks are already taking the lead in making this change. In a bid to provide a more secure lending option, Commonwealth Bank of Australia have introduced their own BNPL alternative called StepPay, which utilises credit checks to prevent users from over borrowing.

But whether this proposed change to regulations will halt the growth of BNPL is yet to be seen, and will be dependent on how the application process shifts. Consumers will likely favour the service with the quickest turnaround time, which may bring credit cards back into the game.

What does the future hold for Buy Now, Pay Later?

While BNPL may not be for everyone, there is little doubt its rapid adoption will continue; and in the process, force the financial sector to evolve in response.

The decision to use BNPL services comes down to financial discipline and personal spending habits. Users are attracted to the convenience and low-risk approach to credit; however, these services can also encourage impulse spending for those with low financial literacy. While the accessibility of BNPL has increased, education about personal finance has not, which creates a dangerous environment for the already struggling middle and lower classes. This puts the services at risk of interference by government regulators which would greatly disrupt their service offering and growth. We can expect to see more and more of these brands investing in their own financial literacy programs to counteract this issue.

In an attempt to compete with BNPL, we are seeing a new wave of interest-free credit cards from banks. But they too are not all they appear to be; many have hidden fees that end up being more expensive than interest on a regular credit card, not to mention their higher regulation and longer application processes. Unless these banks continue to innovate their offerings, consumers will continue to transfer their services to the growing market of BNPL. As BNPL continues to grow, so too will lending limits, providing more reason for consumers to ditch the credit card once and for all.

Lastly, as technology continues to evolve so do consumer expectations. Mobile-first approaches are becoming increasingly popular and physical cards will soon be redundant. It may take some time for credit cards to totally phase out, but the writing is on the wall. So, if you haven’t already invested some time into setting up your digital wallet, now is the time.

“The opinions expressed by BizWitty Contributors are their own, not those of BizCover and should not be relied upon in place of appropriate professional advice. Please read our full disclaimer."