Our trusted insurance partners*

How it works?

4 easy steps to get covered and secure your business

Select your Occupation

Your business details

Compare and select quote

Get Covered In 5minutes

Here’s the lowdown on Public Liability Insurance*

As a small business owner you already have lots to worry about. From paying your employees to getting stock

delivered on time to generating new work opportunities – the list is endless! But have you taken the time to think

about what an accident involving a third party could mean for your business?

As a small business owner, you have a legal responsibility to take reasonable steps for the safety of your customers, suppliers, community and their property.

Public Liability Insurance is designed to provide protection for you and your business in the event a customer, supplier or a member of the public are injured or sustain property damage as a result of your negligent business activities.

Public Liability Insurance also provides assistance with the legal costs associated with managing claims that are covered by the policy.

Get Public Liability insurance under a minute

Search for occupation and compare quotes

What is Public Liability insurance?

Public Liability insurance is one of the most common types of business insurances that a variety of different small businesses choose to take out. It is there to provide protection if someone makes a claim against the insured, the business or its employees. Claims from a third-party can be for personal injury or damage caused to their property caused by your business activities.

What is typically included?**

Personal Injury

Compensation costs for the personal injury suffered by a third party (e.g. a customer, supplier or member of the public)

Legal and Defence

The legal and defence costs associated with a covered claim

Damage to Property

Compensation for damage to property owned by a third party due to your negligent business activities

Damage of third-party goods

Compensation for damage of third-party goods not owned by you which are in your care, custody or control

**Many public liability policies also provide cover for product liability.

What is typically not covered?*

- Injuries to your employees

- Damage to your own property

- Professional negligence

- Costs of rectifying faulty workmanship or product recall

- Professional negligence

- Contractual liability

- Events occurring before or after the policy period

- Aircraft products

- Asbestos

- Liquidated damages

- Gradual pollution

- Punitive damages- where the insured acted so badly that extra damages were awarded

- Liabilities assumed under contract which the insured would not be liable for at common law

Get Public Liability insurance under a minute

Search for occupation and compare quotes

Hear from our customer

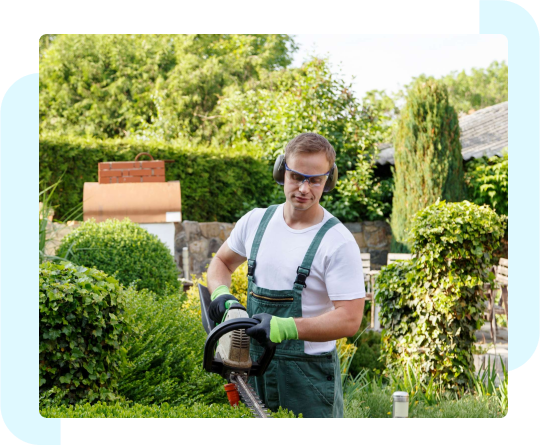

What kind of businesses need

Public Liability insurance?

In a nutshell, if your business is interacting with any third parties like customers, suppliers and members of the public on a regular basis, then you may need to consider Public Liability insurance. The chance of Public Liability insurance claim can be hard to predict, but if it were to occur, the costs to your business could be extremely costly and potentially enough to send you out of business.

Trades

Professionals

Wholesalers

Travel and Toursim

Office Based

Manufacturers

Get Public Liability insurance under a minute

Search for occupation and compare quotes

Why choose BizCover for your Public Liability insurance?

Built for Small Businesses

We know insurance and what makes small businesses tick

Clear and competitive pricing

Clear and competitive pricing

Cover to match your needs

You can tailor policies from selected Australian insurers to suit the needs of your business, and we are there to help!

Real people adding real value

Our friendly service team is on hand and on a mission to make you smile!

Get Public Liability insurance under a minute

Search for occupation and compare quotes

Get the right cover

$5million

$10million

$20million

When deciding on how much cover you should have a think about factors like:

- Do any of your contracts require a minimum level of public liability cover?

- Has your industry body set a minimum level of public liability cover for membership?

- Does your business or trade licence require a minimum amount of public liability cover?

What kind of accidents could occur due to your business operations and what could be the potential cost of a claim?

Frequently Asked Questions

How much does Public Liability Insurance cost?

Toggle content goes here,

Do I need Public Liability insurance?

Toggle content goes here,

How much Public Liability insurance do I need?

Toggle content goes here,

Do I need Public Liability insurance as a sole trader?

content goes here

Is Business Insurance the same as Public Liability?

Toggle content goes here,

Does Public Liability cover professional services or advice?

Toggle content goes here,

Not what you are after? Explore our other business products

Explore Products by Industry

*This information is a general guide only and does not take into account your objectives, financial situation or needs. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording. The information contained on this web page is general only and should not be relied upon as advice. BizCover Limited is owned by BizCover Pty Ltd (ABN 68 127 707 975)*

* The provision of the claims examples are for illustrative purposes only and should not be seen as an indication as to how any potential claim will be assessed or accepted. Cover for a claim will depend on the specific circumstances around the loss and would be subject to the terms and conditions of the policy concerned. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording. The information contained in this article is general only. Coverage for claims on the policy will be determined by the insurer, not BizCover, and will depend on the specific facts and circumstances involved.

Popular Searches

professional indemnity insurance online quote

pi insurance nz solo practitioner

professional indemnity insurance quote online

small business professional indemnity insurance

professional indemnity insurance chartered accountants

affordable fire protection detection professional indemnity

professional indemnity liability insurance

what kind of insurance does a consultant need